See also press release – Two New Reports Highlight Threat of LNG Reliance in the Arctic

Andrew Dumbrille is North America Strategic and Technical Advisor to the Clean Arctic Alliance

April 22nd marks the 54th Earth Day, which has “evolved into the largest civic event on Earth, activating billions across 192 countries to safeguard our planet and fight for a brighter future.” This Earth Day, we would like to invite the shipping sector to step up and show real determination for cleaning up this planet. Here’s how.

This coming July, a ban on use and carriage of heavy fuel oil – shipping’s dirtiest fuel – in the Arctic comes into force. As the sector pivots away towards cleaner fuels, the Clean Arctic Alliance is calling on the shipping industry and governments to hit the pause button before investing in liquified natural gas (LNG) infrastructure for maritime transport in the Arctic. As Arctic shipping moves away from heavy oil-based fuels and towards cleaner energy sources, investors must come to grips with the stark fact that LNG is still a fossil fuel and not a solution for reducing shipping’s impact on global heating. And we’ve got the facts to back it up.

Two new reports, published this week, explore the future potential impacts on our climate from the extraction and use of liquified natural gas (LNG) to fuel the shipping industry. Both reports emphasise the dangerous waters ahead for Arctic States as they seek to implement the forthcoming July 1st Arctic ban on the use and carriage of highly polluting heavy fuel oil.

In the face of diminishing sea ice and a global push for more sustainable fuel options, the Arctic is at a crossroads that could reshape its maritime future. The reports ‘LNG and Shipping in the Arctic‘ by Energy and Environmental Research Associates for the Clean Arctic Alliance and ‘The Status and Future Projections of LNG Production and Use in the Russian Arctic’ – by Clean Arctic Alliance member Bellona, both point to increasing LNG production and use, and a glimpse into how the extraction and use of fossil gas could dominate the Arctic shipping seascape for decades.

In the face of diminishing sea ice and a global push for more sustainable fuel options, the Arctic is at a crossroads that could reshape its maritime future. The reports ‘LNG and Shipping in the Arctic‘ by Energy and Environmental Research Associates for the Clean Arctic Alliance and ‘The Status and Future Projections of LNG Production and Use in the Russian Arctic’ – by Clean Arctic Alliance member Bellona, both point to increasing LNG production and use, and a glimpse into how the extraction and use of fossil gas could dominate the Arctic shipping seascape for decades.

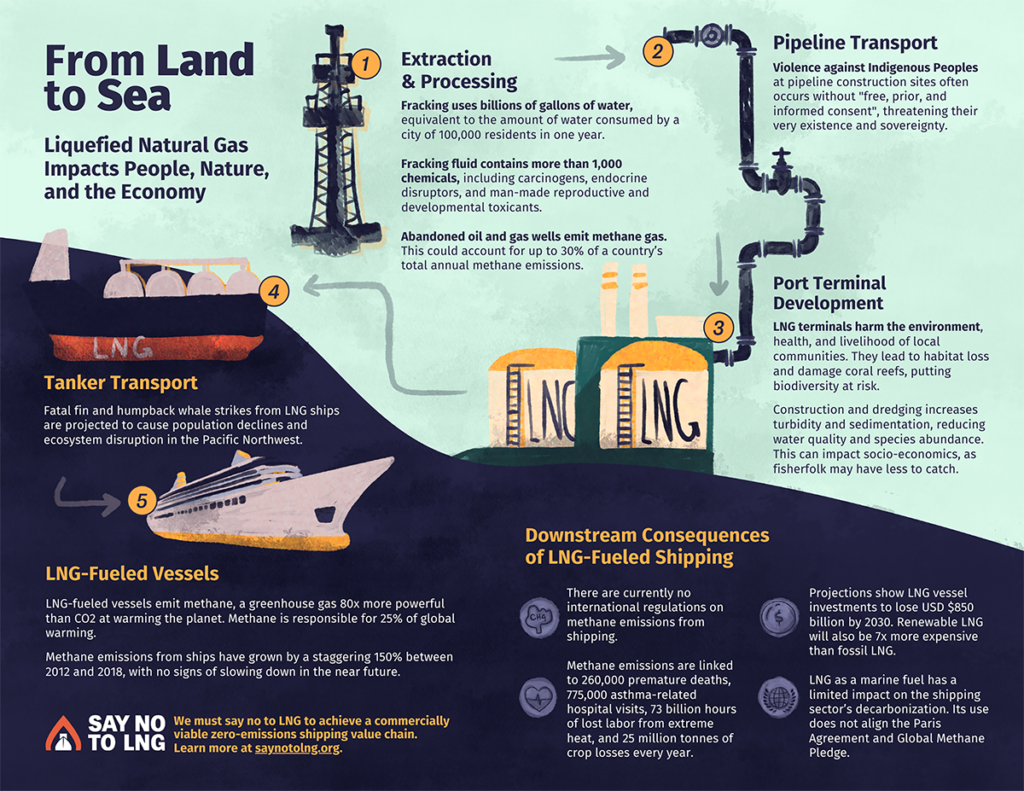

LNG’s lower carbon content, compared to conventional marine fuels, means that it is often mistakenly considered as a climate friendly alternative fuel. However, LNG mainly consists of the potent greenhouse gas (GHG) methane and the global warming impact is more than 80 times that of an equivalent amount of CO2. When LNG’s entire supply chain is considered – including significant methane emissions from extraction, storage, transport and use in ships’ engines, the overall impact in many cases is no reduction in greenhouse gas emissions, but in fact an increase.

Additionally, as with scrubbers, which turn shipping air pollution into an ocean pollution problem, replacing heavy residual fuels with LNG marine fuels simply replaces ship-based air and climate pollution with a new climate pollution problem and community environmental impacts such as contaminated ground water and localised air pollution. Smoke stack CO2 and black carbon is reduced when using LNG on a ship but local communities are put at risk by the extraction of LNG, leading to water and air pollution.

These two new LNG status reports document the LNG industry expansion in the Arctic region, and detail the following dangerous trends:

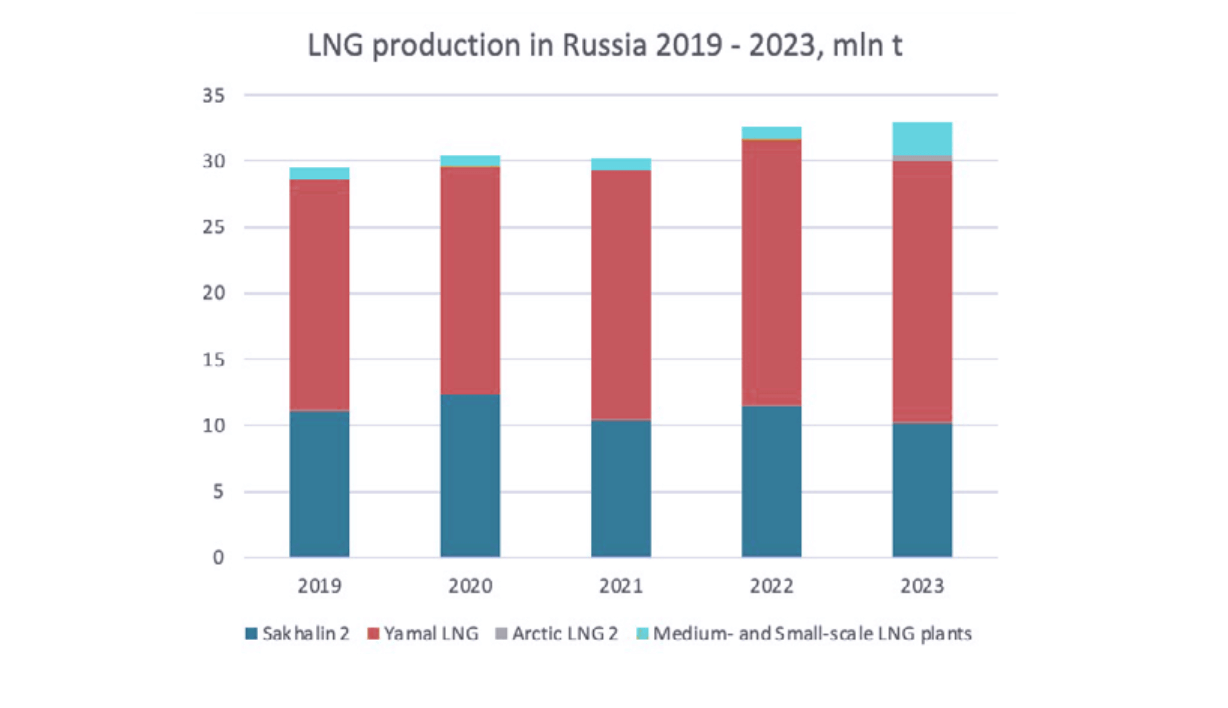

LNG Production

- Russia is the world’s second-largest natural gas producer, with approximately 83% of its gas coming from Arctic territories. Most Russian LNG produced in large-scale facilities is intended for export.

- Russia has ambitious plans to grow its LNG production and export facilities, aiming to increase production significantly by 2035 despite facing challenges from international sanctions, however it is likely that the ability of Russia to continue LNG development will depend on its ability to find new long-term customers.

- Natural gas extraction, processing, and LNG trade in the Arctic nations beyond Russia has grown significantly. There are seven active LNG import terminals and seven active LNG export terminals in the rest of the region. Three more import and 11 export terminals are proposed. Pipelines connect much of the oil and gas extraction infrastructure in the region, with dense networks of pipelines in sub-Arctic Canada and the North Sea.Countries with significant natural gas reserves, such as the United States, Canada, and Norway, are displaying a hesitancy to move away from fossil gas, continuing to explore and expand LNG bunkering capabilities despite their commitments to reducing sector emissions and aligning with international climate goals.

LNG Bunkering

- The global LNG market has seen considerable growth over the last two decades, with over 930 vessels bunkering, consuming, and transporting LNG worldwide, including those on order. This makes the LNG-fueled fleet larger than that of other alternative fuels both in active service and on the orderbook. This disturbing trend puts decarbonization plans and pathways at enormous risk.

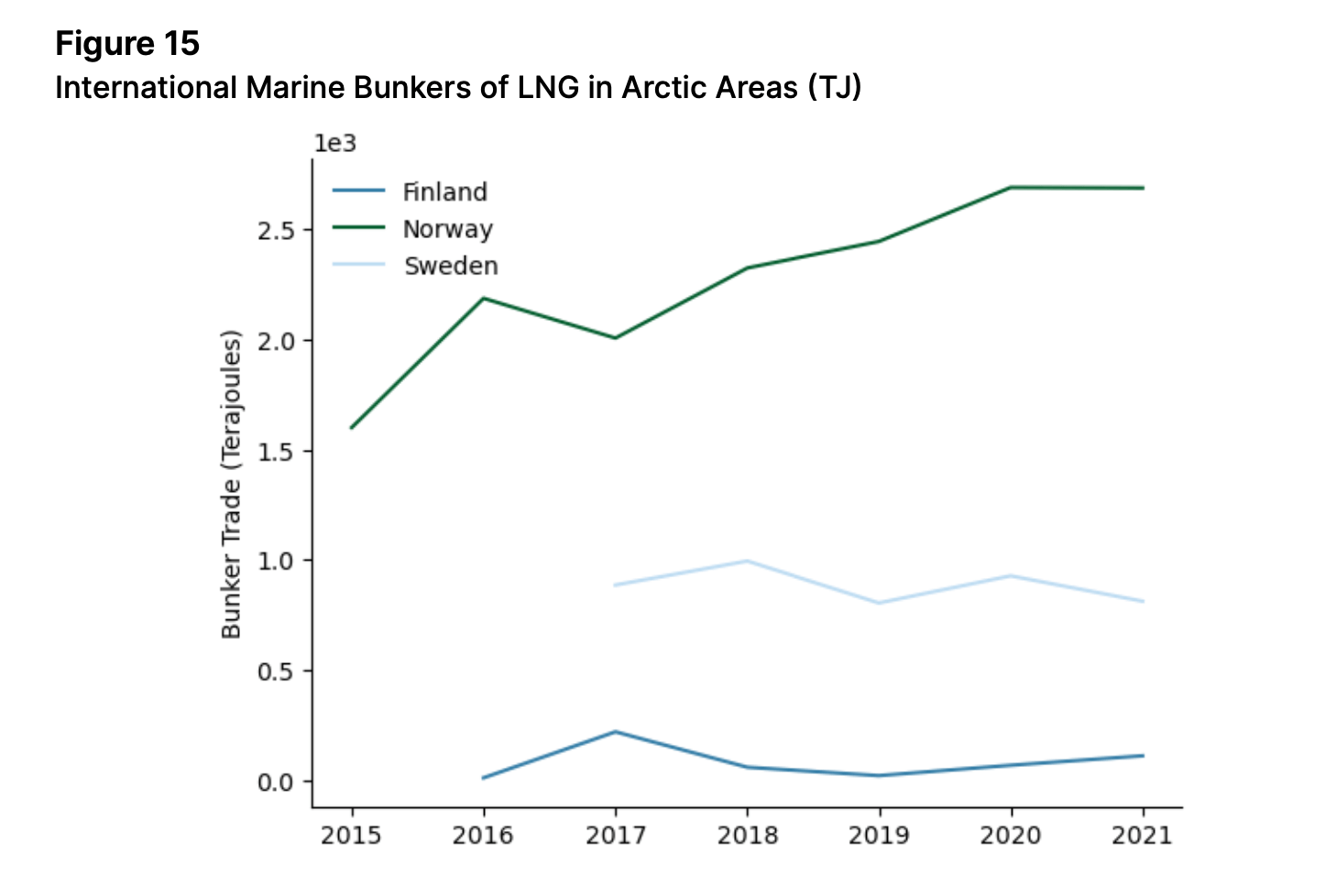

- The geographical distribution of LNG bunkering facilities in the Arctic is currently limited, with the most substantial presence in Scandinavian nations and a few facilities in Canada.

- The growth of LNG bunkering from a handful of operations in 2010 to over 30 operational and proposed facilities, highlighting the region’s commitment to adopting LNG as a marine fuel despite the environmental concerns.

- In Russia, the use of LNG on ships is restricted to the export of oil and gas. Almost all LNG-run Russian vessels are oil tankers, and LNG carriers which use boil-off gas while carrying the cargo.

- In other Arctic countries the initial growth of the Arctic-capable fleet was dominated by LNG tankers, oil and gas vessels, and RoPax vessels, but recent years have also seen growth in other shipping sectors, including chemical tankers, RoRos, service vessels, and container ships. Norway has the largest fleet register for Ice Class LNG vessels in the region (including the state register and NIS), followed by Sweden and Finland. Norway also has 8 LNG-fueled fishing vessels, with two on order. The orderbook shows around 55 Arctic-capable LNG vessels, mostly RoRos (20 vessels), and chemical/products tankers (20 vessels).

- Russia, Finland, and Sweden have made more substantial investments in LNG bunkering infrastructure compared to other Arctic countries. Their approach unfortunately reflects a misguided optimism towards LNG as an alternative marine fuel which ignores the life cycle impacts. (insert chart on page 45 of EERA report)

The analysis in both reports underscores a critical point in the discussion about LNG’s role in the Arctic and globally: LNG’s overall environmental impact, particularly in terms of methane emissions, means looking elsewhere for truly zero emission alternatives. As policies and technologies evolve, the focus on well-to-wake emissions – i.e. the emissions generated from through the extraction for, and use by, the maritime sector and the broader environmental impacts of fuel choices will be crucial in guiding the maritime industry towards more sustainable practices.

The Clean Arctic Alliance, which is a member of the Say No to LNG campaign, believes that Earth Day – and the impending HFO ban are perfect opportunities to tack and jibe the Arctic shipping fleet away from a voyage plan that includes LNG. Eliminating the use of heavy residual fuels, reducing black carbon emissions and choosing distillate fuels along with investment in energy efficiency and wind are clear short and long term winners to meet climate and sustainability targets without locking in potent climate-forcing LNG fossil fuel infrastructure for 30 more years.

By Saying No To LNG now, those interested in pumping money into the shipping sector will unlock investments in truly zero emission alternatives. In addition, it means that countries can implement the HFO ban without turning from one hazardous fossil fuel to another. The cure must not be worse than the poison – so this Earth Day, let’s turn to solutions that are better for the industry, better for the planet, and for the health and wellbeing of those who live on it.

Andrew Dumbrille is North America Strategic and Technical Advisor to the Clean Arctic Alliance